Georgia GOAL

Georgia Goal Program

.png)

WHAT IS GEORGIA GOAL?

The Georgia GOAL Scholarship Program is a remarkable initiative that enables individuals and businesses to help deserving students access a quality K-12 education that may otherwise be out of reach.

The overwhelming success of the GOAL program speaks volumes about its importance. Year after year, demand surpasses the allocated cap of $120 million within the first business day of the year. This leads to proration of all applications, as witnessed in 2024 when applicants received only 63% of their requested amount due to oversubscription. We anticipate a similar scenario for 2025.

WHO BENEFITS FROM YOUR SUPPORT?

All Georgia taxpayers can receive a 100% state income tax credit in exchange for their contributions to Georgia GOAL. Funds raised through GOAL are used to provide tuition assistance for exceptional students desiring to attend Queen of Angels Catholic School. Previously, QA utilized GRACE Scholars to administer this program. As we advance, the school is now utilizing the services of Georgia GOAL, the state’s leading Student Scholarship Organization (SSO).

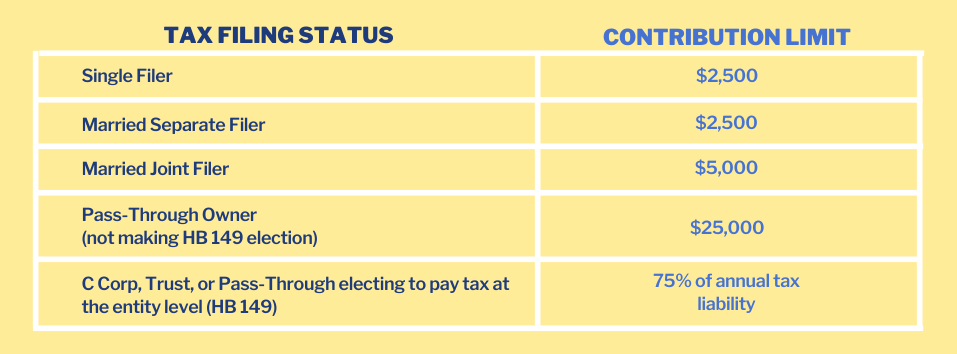

Contribution limits based on taxpayer filing status are as follows:

HOW DO I REGISTER?

To secure your 2025 GOAL tax credit, you must submit your application before the end of 2024. Apply today by visiting goalscholarship.org. GOAL will handle all remaining steps in the process until your contribution is due in mid-March 2025, within 60 days following approval by the Georgia Department of Revenue.

![]()

Please help us make the most of this winning program, and let’s make every GOAL count! Your participation empowers students to receive an excellent education, supports families in choosing the best educational environment for their children, and strengthens the well-being of our school community.

The overwhelming success of the GOAL program speaks volumes about its importance. Year after year, demand surpasses the allocated cap of $120 million within the first business day of the year. This leads to proration of all applications, as witnessed in 2024 when applicants received only 63% of their requested amount due to oversubscription. We anticipate a similar scenario for 2025.

The Georgia Private School Tax Credit Program allows participants to redirect tax liability already owed to the State of Georgia to a restricted priority (financial aid) at a favorite school. Therefore, Participation in the program is unrelated to participation in the QA Annual Fund.